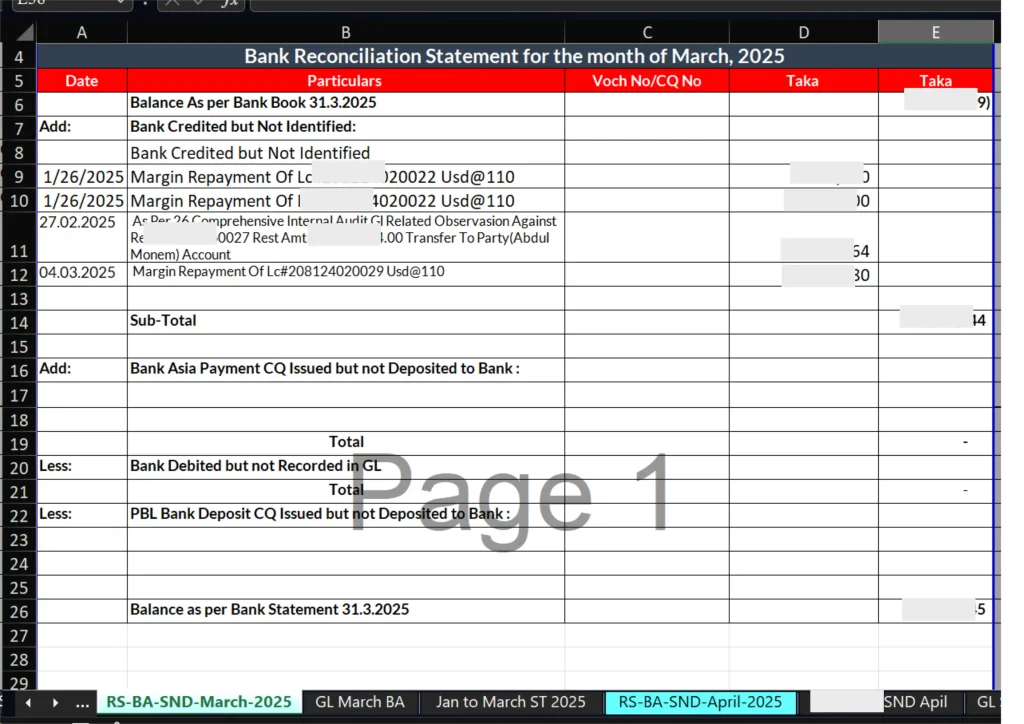

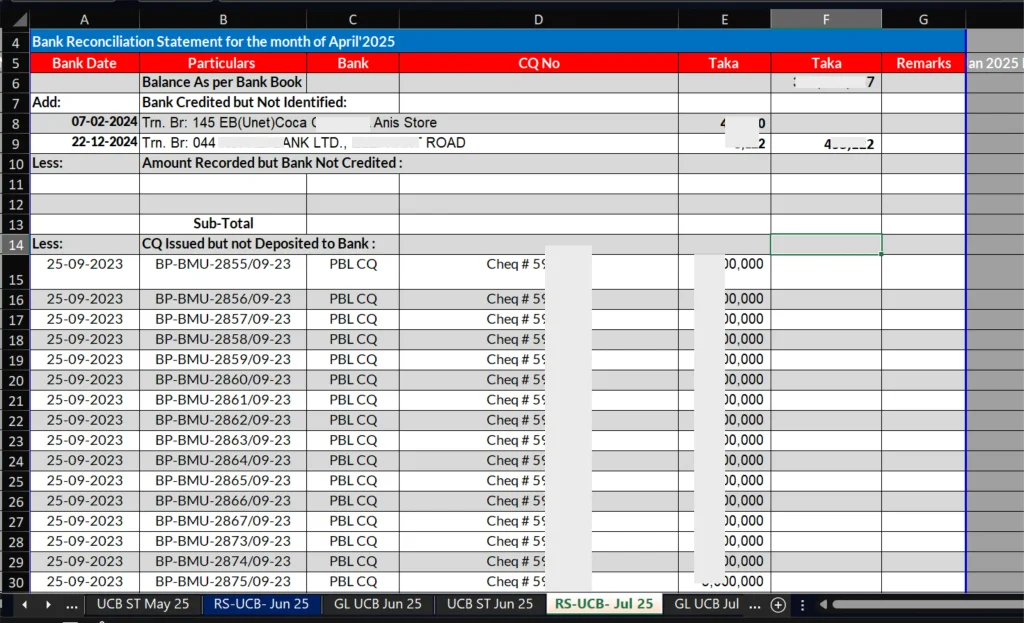

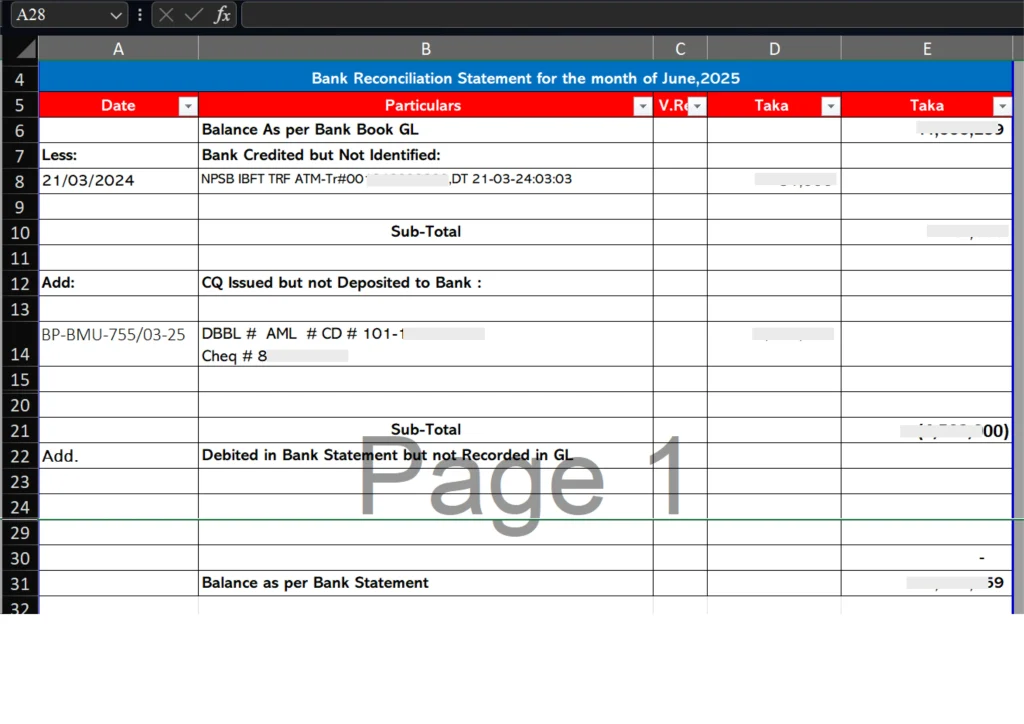

Noor Hossain has extensive hands-on experience in providing bank reconciliation services, managing reconciliation work for more than 20 banks over a continuous period of nearly three years. This experience covers both routine and complex reconciliation processes, ensuring that bank statements are accurately matched with accounting records on a regular basis.

Throughout this period, Noor Hossain has been responsible for identifying and resolving discrepancies such as timing differences, unrecorded transactions, bank charges, interest adjustments, cheque issues, and posting errors. Each reconciliation process is performed with strong attention to detail to ensure accuracy, completeness, and compliance with internal control requirements. Regular reconciliations have played a critical role in maintaining reliable financial data and supporting smooth month-end and year-end closing activities.

The work involves handling high transaction volumes across multiple bank accounts, maintaining structured reconciliation schedules, and preparing clear supporting documentation for audit and management review. Advanced Excel techniques are used to automate matching, analyze variances, and improve reconciliation efficiency, reducing manual effort and turnaround time. The reconciliation process is designed to ensure transparency, traceability, and consistency across all bank accounts.

This long-term, continuous engagement across more than 10 banks demonstrates strong practical knowledge, reliability, and the ability to manage ongoing financial operations effectively. The experience reflects a professional approach to bank reconciliation that supports accurate financial reporting, improved internal controls, and informed business decision-making.